Jump to:

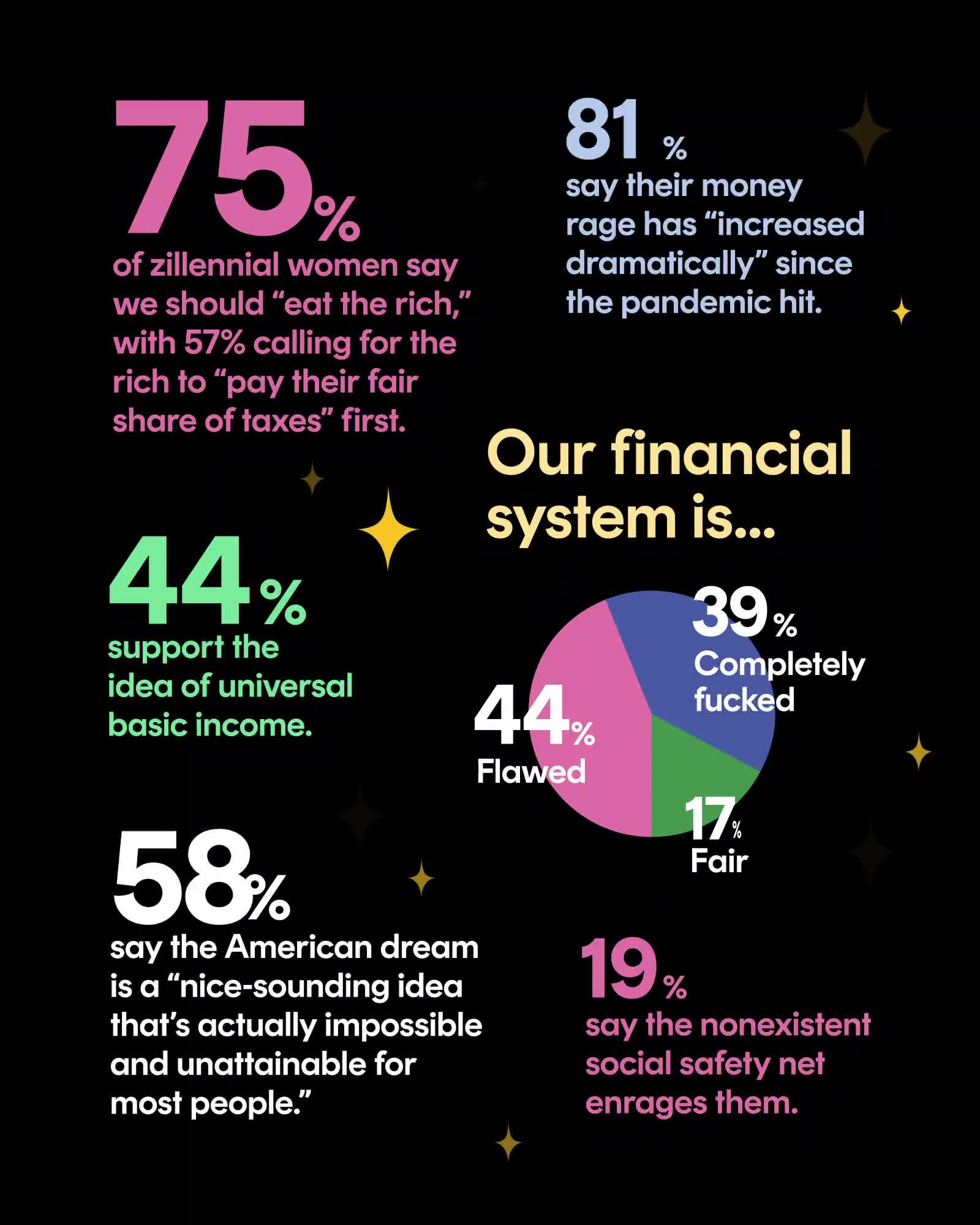

Maybe it was the ATM fee that plunged your account into overdraft or a rent hike that stretched your budget past the brink. It could have been a boomer calling you out for buying too much avocado toast (which…you’ve never actually done) or someone you follow on Instagram posting a “new house who dis” pic without acknowledging it was a cash offer funded by the Bank of Mom and Dad. Whatever set you off, it’s clear that money rage—yours, ours, everyone’s?—is in the air. Our survey of zillennial women quantified the vibe: A large share of you are beyond the point of ambient financial frustration and are feeling full-on livid. And when we asked you to sound off on the subject, your responses revealed a widespread struggle to survive, let alone thrive, in a shit-sandwich economy that feels less sustainable by the day.

“The social system is becoming unlivable for many people, including some who are relatively privileged,” says cultural philosopher Nancy Fraser, PhD, author of Cannibal Capitalism. This, friends, is what happens when lack of money + lack of time + lack of options = declining quality of life for folks across the board.

And make no mistake, Fraser adds: It’s a feature, not a bug. “The system incentivizes powerful investors, corporations, and people dedicated to amassing more and more profit to help themselves freely to a lot of non-monetized resources—from nature and environment to the unwaged care work that women especially do in families, communities, and neighborhoods.” And now? Many of us have hit our breaking point, which explains why we seem to be witnessing “a multidimensional crisis of the whole social order,” says Fraser, one that many young women have long sensed was coming.

At the same time, Cosmo’s survey (see below) revealed glimmers of promise, a belief that this system might not have to be this way. Respondents showed broad support for programs that guarantee everyone a basic income, for the expansion of health care services and debt cancellation, for universal childcare and family support policies that actually support families. Admittedly, the gap between “appealing” and “possible” feels pretty huge right now. The hope here is that catharsis can bring us a little closer. Because if you’re angry…well, you’re paying attention.

Findings from a Cosmopolitan survey of 501 women ages 18 to 44, conducted via SurveyMonkey in December 2022.

The Specific Sh*t You’re Pissed About

And a rundown about the actual root of the problem.

When we asked you who was responsible for your financial frustrations, 38 percent placed the blame on…yourselves. Here’s the thing though: A lot of rage-y money experiences are manifestations of a much larger macro mess. This is how your own issues fit into the bigger picture. (And PSA: Give yourself a break, please.)

The Ideal Path for Your Particular Brand of Rage

Are you more corporate subterfuge or alt-rebel: Let’s find out, shall we?

The Deserving Human Targets of Your Fury

Time for a collective primal scream: These are the folks you deemed most infuriating when it comes to money issues.

The Schadenfreude You Feel? It’s Fine

Why rooting for the ruination of financial villains is arguably healthy.

Go ahead. Mock Samuel Bankman-Fried. It’s fine. In fact, it speaks well of you to delight in the ruin of this man-baby billionaire and founder of the dubious crypto exchange FTX, a person once hailed by Forbes as the “richest 20something in the world.” You are not a bad person if you tingle with pleasure because Sam was barred from his vast Bahamas fiefdom, legally grounded at his parents’ house while awaiting trial for eight criminal counts of fraud and other charges.

If you relish the idea of him flipping forlornly through his childhood Harry Potter novels, yearning to be a precocious magic boy again, you are petty. You are also virtuous.

“When we root for the wealthy getting their due, it may stem from our justice system’s legacy of letting them off the hook,” says therapist Megan McCoy, PhD, assistant professor of personal financial planning at Kansas State University. (Bankman-Fried has pleaded not guilty to all charges.) These rare instances can feel like a correction for all that we know to be inequitable and financially fucked up.

Sure, check yourself if you’re rooting against real people you know—well, the ones who aren’t running Ponzi schemes—which can be a symptom of harmful envy, says McCoy: “Then we need to start a self-reflection process that explores how we can gain more confidence and overall okayness with our own life course.” Otherwise, laugh away.

The Ticketmaster Snafu Is the Perfect Case Study

How the fury of the Swifties led to an antitrust investigation.

For those personally traumatized by the online ticketing nightmare of Taylor Swift’s Eras Tour last November, please accept our sympathies. For anyone who missed the melee, a recap: Before tickets went on sale, Ticketmaster, the exclusive seller, created an early-access link for “verified fans.” The goal was to outsmart bots and scalpers. That very much did not work.

The site crashed and glitched, stranding fans in the queue for hours, with many losing their seats on the checkout page. A batshit resale market arose, in which a single ticket climbed to nearly $95K.

Millions of furious people melted down on social media, inspiring many a meme. But the debacle also marked a consciousness-raising moment, as fans connected their experiences to broader economic critiques of how mega-corporations with outsize market shares can become de facto monopolies that mistreat customers with impunity. The twist here is that the fandom didn’t stop at merely being mad—they mobilized for vengeance.

Fifty-plus Swifties who also happen to be lawyers, comms pros, tech workers, and government employees formed a group called Vigilante Legal—after Taylor’s song “Vigilante Shit”—and filed a Federal Trade Commission complaint against Ticketmaster and its parent company, Live Nation. (The group’s tagline: “Look what you made us do.”) Meanwhile, the Gen Z–led pro-democracy platform Voters of Tomorrow unleashed SWIFT—Swifties Working to Increase Fairness From Ticketmaster—to advocate for broader antitrust legislation. Some 250-plus fans have now joined a separate class-action lawsuit under California’s Unfair Competition Law, seeking what could be millions in cash damages. And the U.S. Department of Justice is reportedly planning to pursue an antitrust investigation of its own.

Call it a successful pilot experiment in class rage: If enough people get pissed enough about something at the same time, it’s possible to take on powerful systems.

The Financial Advice You *Actually* Deserve

Save for a down payment, you say? How about I open a STFU account.

Nothing sparks money rage quite like advice that doesn’t even remotely reflect the realities of your life. These five ancient, ubiquitous tips—even if they work for some people—just need to die already. There, we said it!

Erin Quinlan is a journalist in New York City and the features director at Cosmopolitan.